Juguetes de Playmobil aventuras en la nueva casa moderna de lujo de Playmobil en español - Dailymotion Video

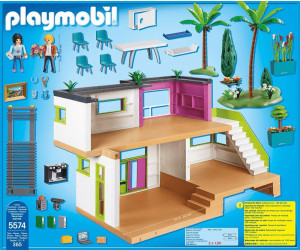

Casa Moderna De Lujo De Playmobil CON CAJA De Segunda Mano Por 99 EUR En Camarma De Esteruelas En WALLAPOP | cvetexpress.rs

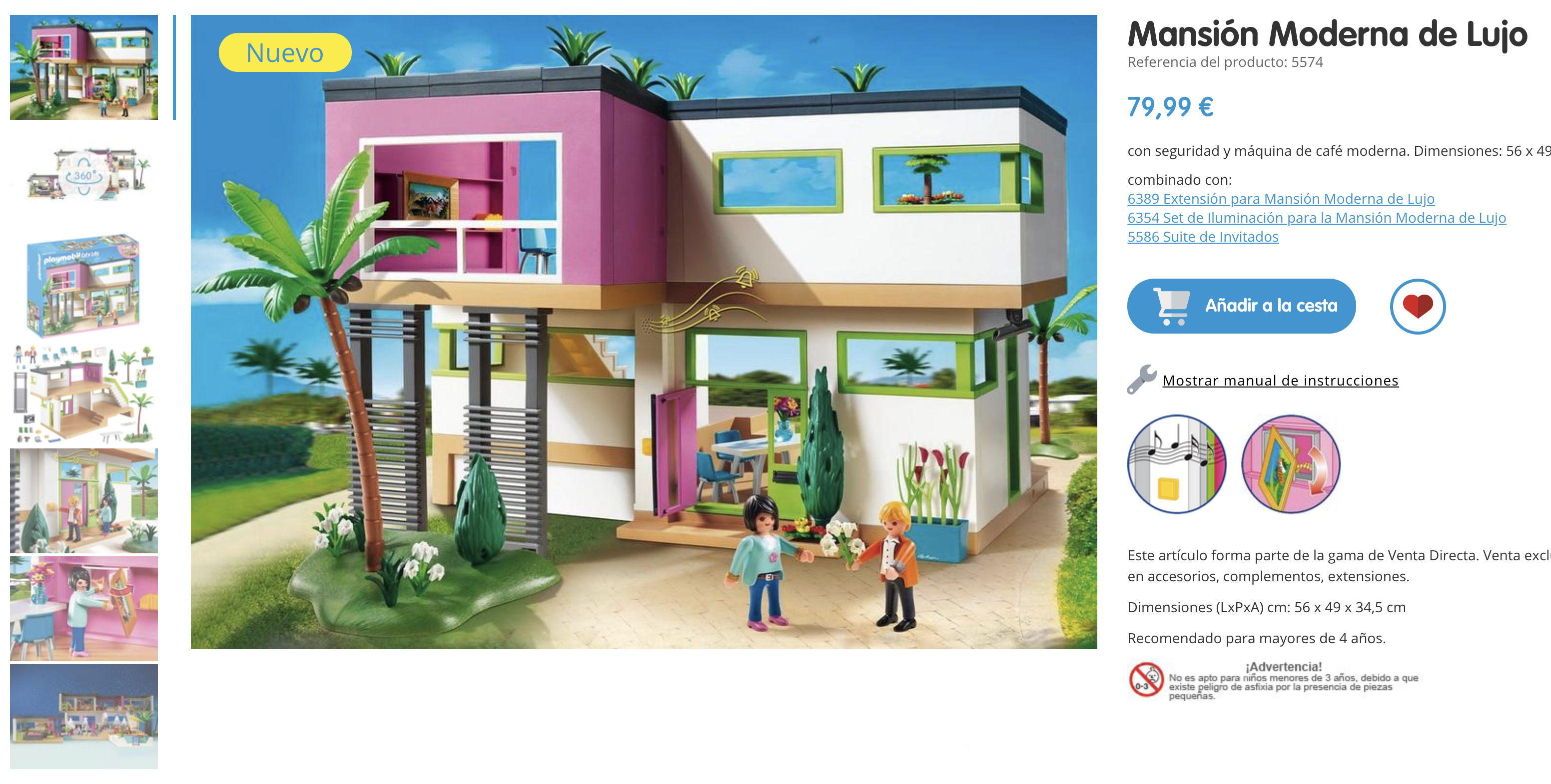

PLAYMOBIL Mansión Moderna de Lujo - Cocina de diseño Abierto, playset (5582) : Amazon.es: Juguetes y juegos