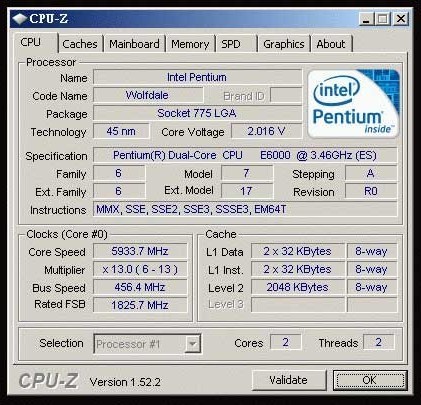

FREE SHIPPING E6700 CPU Processor (3.2Ghz/ 2M /1066GHz) Socket 775 SLGUF scrattered piece|processor sale|processor xeonprocessor i7 - AliExpress

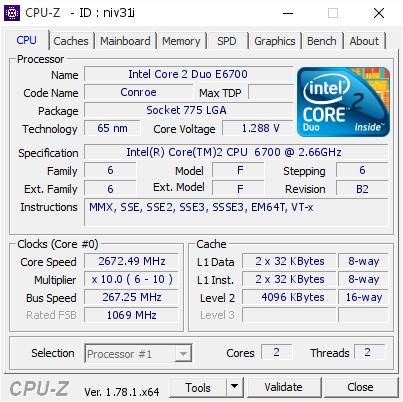

Buy Intel CPU Core2 E6700 CPU 2.66GHz 775pin/4MB Cache Dual-CORE 65W Online in India at Lowest Prices - Price in India - buysnip.com

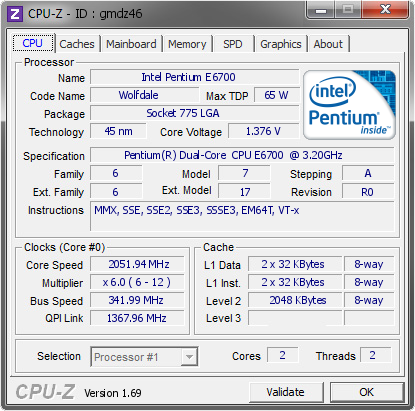

Intel Pentium E6700 Processor 3.20 GHz 2 MB Cache Socket LGA775 並行輸入品 :20220607173350-01262us:神戸リセールショップ5号店 - 通販 - Yahoo!ショッピング

Intel Pentium E6700 Cpu Processor (3.2ghz/ 2m /1066ghz) Socket 775 Free Shipping - Cpus - AliExpress

Buy BX805576700-Intel Pentium E6700 Dual Core 3.20GHz 1066MHz FSB 2MB L3 Cache Socket LGA775 Desktop Processor | ICT Devices

Intel Pentium Dual-core E6700 3.2 Ghz Dual-core Cpu Processor 2m 65w 1066 Lga 775 - Cpus - AliExpress

-800x800.jpg)