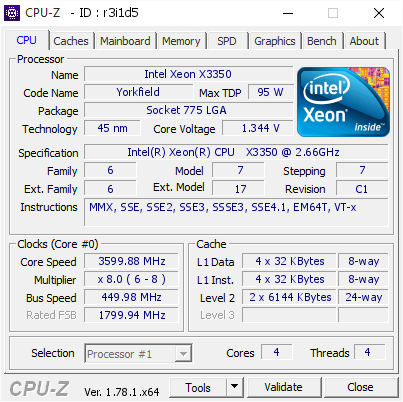

IBM System x3200 M2 4368 - Server - MT - 5U - 1-way - 1 x Xeon X3350 / 2.66 GHz - RAM 1 GB - SAS - hot-swap 3.5" - no HDD - DVD - ATI ES1000 - Gigabit Ethernet - Monitor : none | Elarasys

Xeon X3350 2.66ghz 12mb 1333mhz Sockel Socket Lga775 Processor Cpu - Buy X3350,X3350 Cpu,Cpu Product on Alibaba.com

Hewlett Packard Enterprise Intel Xeon X3350 processor 2.66 GHz 12 MB L2 - Protsessorid - Süsteemikomponendid - Computer Components - MT Shop